risks associated with closed end funds

The Advantages and Risks of Closed-End Funds. Market Risk Of Capital Loss.

A Lesson On Leverage In Municipal Bond Closed End Funds

This can be a retail product for those who can stomach the associated risks in their search for relatively high-potential income and gains.

. What are the risks of closed-end funds. The following dates apply to todays distribution declaration for each fund. CEFs are primarily designed.

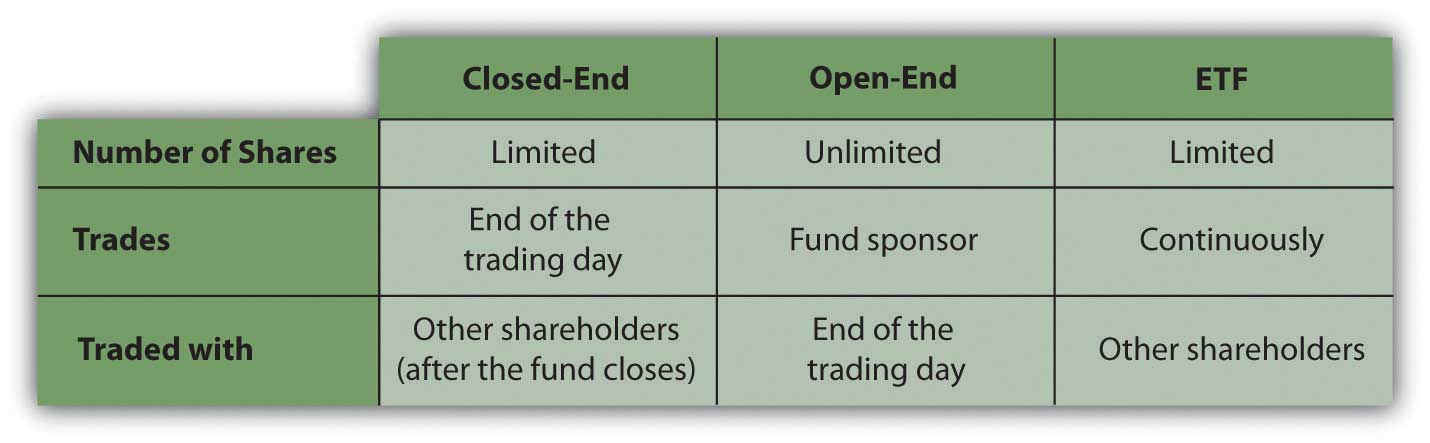

Closed end investing involves risk. Closed-end funds are a type of investment company whose shares are traded in the open market like a stock or ETF. Some closed end funds have more risk than others.

Closed-end funds can offer advisers. Investors should contact a funds sponsor for fund-specific risk information andor contact a financial advisor before investing. What are the risks associated with Closed-end Funds.

The Allspring Income Opportunities Fund is a closed-end high-yield bond fund. There are also non-listed CEFs with continuous subscriptions and regular typically quarterly. Risk factors pertaining to closed-end funds vary from fund to fund.

A closed-end fund is one of three main types of investment companies that the Securities and Exchange Commission regulates. This site does not list all of the risks associated with each fund. Closed-end funds CEFs can be one solution with yields averaging 673.

What are the risks associated with Closed-end Funds. What are the risks associated with Closed-end Funds. Buy CEFs at larger than normal discounts to NAV and sell them when the discounts.

Like any investment product closed-end funds come with a range of risks which well cover next. The investment return and principal value will fluctuate and investors shares when sold may be. Initial offering fees and egregious management fees.

Small- and mid-cap securities may be subject to special risks associated with narrower. The term feature ensures NAV liquidity upon maturity. Closed-end funds CEFs can be popular vehicles for portfolio diversification in the long-term although these funds come with certain volatility risks.

And this was typically historically this has typically been from preferred shares or from debt. The following list of risk factors provides a review of those associated. Allspring Utilities and High Income Fund.

The two other main types of investment. Please see each products web page. George uses the following investment strategies1 Opportunistic Closed-end fund investing.

Many closed-end funds are all about collecting high fees from investors. Expense ratios or the cost of owning the fund each year may also be lower compared to some open-end funds. Their yields range from 632 on average for bond CEFs to 722 for the average stock CEF.

General Risk Factors Related to Closed-End Funds. For those seeking to earn higher yields than available from mutual funds closed-end funds can be enticing due to their low-cost leverage. Capital does not flow into or out of the funds when shareholders buy or sell.

Closed-end funds pool investors capital during an IPO period invest in stocks bonds or other securities according to an overall investment objective. Listed CEFs can offer intra-day liquidity.

Closed End Mutual Funds Video Khan Academy

The Advantages And Risks Of Closed End Funds Aaii

Understanding Leverage In Closed End Funds Nuveen

Closed End Fund Trading Costs And Risk Disclosure Asi

Characteristics And Risks Of Closed End Funds Benjamin F Edwards Financial Advisors

The Lowdown On Closed End Funds Cefs

Closed End Funds From All Angles

What Are Closed End Funds Fidelity

Open End Funds Vs Closed End Funds Smartasset

Key Concepts Of Closed End Funds Nuveen

Want Income Closed End Funds Offer Yield But Beware Of The Risks Stock News Stock Market Analysis Ibd

Closed End Funds Look Appealing But Weigh The Risks Wsj

Pros And Cons Of Closed End Funds

What Are Closed End Funds 3 Risks That Destroy Wealth

Here S Why Closed End Funds Can Have Higher Payouts Seeking Alpha

High Return Low Risk Investment Combining Market Timing Stock Selection And Closed End Funds Thomas J Herzfeld Robert F Drach 9780399126420 Amazon Com Books